Ajusto can help you take control of your premium. Watch the video to see how

3 min 12 s

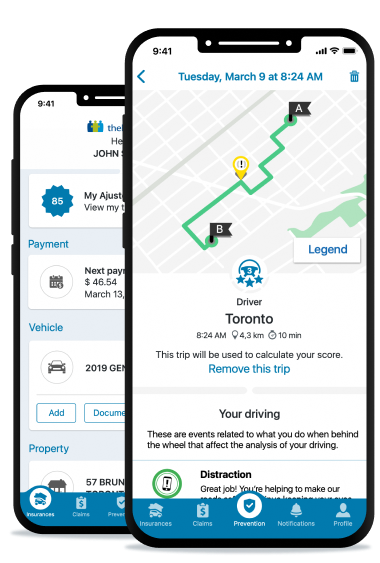

Ajusto takes into account your driving behaviour and habits to offer you a more personalized auto insurance premium. Ajusto is available free in our mobile app. Watch the video to see how it works.

With Ajusto, you can take control of your auto insurance premium

Note: Information in square brackets describes the video's visual and audio content other than dialogue or narration.

[Context: A cartoon explaining the advantages of the Ajusto app and how it works. Throughout the video, a narrator reads the audio content. The text in square brackets describes audio and visual content in the video other than the dialogue or narration.]

[On-screen action: The Desjardins Ajusto app is displayed on a cellphone. The background is a bird'seye view of a highway winding through a forest.] [On-screen text: The Ajusto® program.] The Personal is offering the Ajusto program for free in The Personal app. [On-screen action: Over-head view of cars on highways and overpasses, all displaying the Ajusto app's signature letter "a".] Ajusto takes into account your driving behaviour and habits to offer you a more personalized auto insurance premium. [On-screen text: Steps 1 2 3.] Let's look at how it works in 3 steps. [On-screen action: A small car is featured to the left of a cellphone.] [On-screen text: Step 1. Download The Personal app.] Step 1 Download The Personal app on your smartphone and enter your policy number. [On-screen action: A check mark is displayed on the cellphone. City skyline in the background.] Go to the Ajusto section under the Prevention tab and sign up for the program through the app. [On-screen action: The cellphone displays a map of a sample driving route. House appears to the right with a Wi-Fi symbol above the roof.] You don't need to have a data plan to use Ajusto. Your driving data will be sent when your phone is connected to Wi-Fi. [On-screen action: Cars driving on a highway in both directions. Speedometer appears on the right side of the screen.] [On-screen text: Step 2. Drive safely.] Step 2 Drive safely. Once Ajusto is activated, it will analyze when, where and how you drive to calculate your overall score. Ajusto looks at: [On-screen action: Cars continue to drive on the highway. A traffic sign pops up indicating MAXIMUM 50.] [On-screen text: How fast you drive.] How fast you drive [On-screen action: Cars on highway suddenly speed up and knock and spin the sign. The outline of a hazard sign appears.] [On-screen text: How quickly you accelerate.] How quickly you accelerate [On-screen action: View from the side. A car on the left nearly rear ends a car on the right.] [On-screen text: How hard you brake.] How hard you brake [On-screen text: Safe distance.] Always keep a safe distance from the vehicle in front of you. It gives you more time to brake gently and avoid a collision. [On-screen action: A cellphone with blank chat bubbles appears. Background is a vehicle dashboard, symbolizing texting at the wheel.] [On-screen text: How often you look at your cellphone.] How often you look at your cellphone Ajusto also looks at: [On-screen action: Numbers add up on a speedometer.] [On-screen text: How far you drive.] How far you drive [On-screen action: Clock hands turn very quickly.] [On-screen text: When you drive.] When you drive [On-screen action: Overhead view of a dotted line making its way through a city, symbolizing a driving route. The Ajusto app letter "a" pops up when the car has completed the route.] [On-screen text: Where you drive daily.] Where you drive daily [On-screen action: A car is parked to the left of a cellphone featuring risk factors, like Distance, Time of the day and Trip routines.] [On-screen text: Step 3. Learn more about your driving habits and check your score.] Step 3 Learn more about your driving habits and check your score. [On-screen action: Numbers quickly decrease and increase, symbolizing driving scores.] Ajusto gives you personalized tips to improve your driving. You can also see your score. The higher your score, the more you save! [On-screen action: Return to the screen with cars driving on highways and overpasses. A hazard symbol pops up.] [On-screen text: Safe driving habits can help reduce your auto insurance premium by up to 25%.] Safe driving habits can help reduce your auto insurance premiums by up to 25%. It pays to drive safely. But if you’re more of a risk taker, your premiums could increase by up to 20%. [On-screen action: City skyline in background, foreground features cellphone with 10% discount on screen.] [On-screen text: Join the program!] Join the program! Join the program and get rewarded for your safe driving habits! You can sign up for Ajusto at any time. No need to wait until your insurance is up for renewal. [On-screen text: 10% discount the first 6 months.] You'll get a 10% enrolment discount on your insurance for the first 6 months. [On-screen action: Return to cars moving along a highway in both directions. City skyline in background.] [On-screen text: 180 days and 1,000 kilometers.] After 180 days and 1,000 kilometers, you'll get an insurance premium based on when, where and how you drive. [On-screen action: 10% appears, first with a downward-pointing arrow, then with an upward-pointing arrow.] [On-screen text: 10%.] Your premium may be lower or higher than it was with your 10% enrolment discount. [On-screen text: Sign up today!] Sign up today! [On-screen text: Get a quote. Thepersonal.com/ajusto Not a The Personal client? Get a quote. thepersonal.com/ajusto [On-screen action: The Personal logo appears.] [On-screen text: The Personal Home and Auto Group Insurer. Group rates. Preferred service.] [On-screen legal text: Certain conditions, exclusions and limitations may apply. The discount and the personalized premium do not apply to certain endorsements or additional coverages. Ajusto®is underwritten by The Personal, which refers to The Personal General Insurance Inc. in Quebec and The Personal Insurance Company in all other provinces and territories of Canada. ®Ajusto is a registered trademark of Desjardins General Insurance Inc., used under licence.] [End of text transcript]

Respecting the speed limit is an excellent way to reduce the risk of an accident.

Smooth acceleration will give you a higher score.

[On-screen action: A double-direction arrow grows and separates the cars to a safer distance.]

Using a cellphone while driving is one of the main causes of accidents. Don't use it to help make the roads safer for everyone.

The shorter your trip, the lower your risk of getting into an accident.

Drivers are more likely to get into accidents during certain times of the day, like at dusk.

The more regular your daily routine, the less likely you are to encounter surprises and get into an accident. That means your score will be higher.

With Ajusto, get a more personalized premium based on your driving!

Sign up for Ajusto and get a 10% enrolment discount on your auto insurance premium for the first 6 months.

After that, you’ll get a more personalized premium based on your driving, and every time you renew.

Good to know: nearly 90% of our clients signed up for Ajusto have reduced or maintained their car insurance premium.1

How does Ajusto work?

You control your score and your auto insurance premium

Other factors

What’s the Ajusto score for?

Your score is based on your overall driving

Ajusto calculates your score based on all of your driving behaviours and habits, not on one-off events.

For example, if you brake hard to avoid a collision, this won’t affect your score.

If this type of event happens, you can remove trips from the app that don't reflect your good driving habits.

Your score helps personalize your premium

After a 180 day period and at least 1 000 km of driving2, your score can be used to raise or lower your auto insurance premium

—

• By driving safely, you could see a premium reduction of up to 25%.

• Riskier driving could mean a premium increase of up to 20%.

Good to know: nearly 90% of our clients signed up for Ajusto have reduced or maintained their car insurance premium.1.

After that, each time you renew, you benefit from a premium that’s personalized based on your driving during the last 6 months.

—

Your premium is also based on traditional factors, like past claims, driving violations or a change of address.

Is Ajusto right for you?

- Safe driving comes naturally to you!

- You’re open to using Ajusto on your smartphone.

- You like the idea that your good driving is finally being recognized with a personalized premium.

- You have an iPhone running iOS 15 or later or a smartphone running Android 11 or later.

- You want to help make the roads safer by putting the tips in the app into practice.

Congratulations, this program is for you!

Take control of your auto insurance premium.

Learn more

You can opt out of the Ajusto program at any time. In the app, go to Profile. Under Account management, select Settings, Ajusto, and then Stop using Ajusto. Ajusto then stops recording your trips. We'll update your auto insurance policy and send you a confirmation by email.

If you just delete the app from your phone, you are still signed up for the Ajusto program. To opt out, you must select Stop using Ajusto.

If you opt out of the program and have not driven 1,000 km in the last 6 months:

- You lose your sign-up discount or any other favourable adjustment to your premium.

- You keep any existing unfavourable adjustments on your premium.

If you opt out of the program and have driven more than 1,000 km in the last 6 months:

- If your score is 60 or higher, we remove all existing adjustments (both favourable and unfavourable) from your premium. This means you’d no longer have a personalized premium based on your driving.

- If your score is 59 or lower, we apply an unfavourable adjustment to your premium.

If you want to try to improve your driving with Ajusto again, you can sign up for the program to start a new 180-day trip analysis period. Note that you won't receive the 10% sign-up discount this time. At the end of the new period, we personalize your premium based on your new score.

It depends. We know that there are times when you need to accelerate fast to let an ambulance through or to brake hard to avoid a collision. That's why your score isn't based on one-off events. Instead it's calculated on your driving profile as a whole.

If this type of event happens, you can delete trips from the app that don't reflect your good driving habits.

Yes, but by driving safely, you could see a premium reduction of up to 25%. Riskier driving could mean a premium increase of up to 20%.

Good to know: nearly 90% of our clients signed up for Ajusto have reduced or maintained their car insurance premium.1

When you renew your auto insurance policy, your premium also takes into account traditional factors like your age, gender, vehicle model and year, driving convictions and claims.

If you become ineligible or we are required to end your participation in the program, you are no longer eligible to receive any sign-up discount or favourable program adjustment; however, any unfavourable program adjustment continues to apply.

Discover The Personal app

With our mobile app, it's easy to sign up for the Ajusto program, manage your insurance, access your digital proof of auto insurance3 and make a claim.

Already insured with The Personal? Download the app today!

Privacy

At The Personal, we’re committed to respecting our clients’ right to privacy. For more information, read our Management and Protection of Personal Information Policy for mobile application users and the Ajusto program terms and conditions.