Get a quote

Prefer to call us?

18884768737Water damage is now the number one cause of home insurance losses. The good news is that there are lots of ways you can prevent water damage and save on your home insurance too!

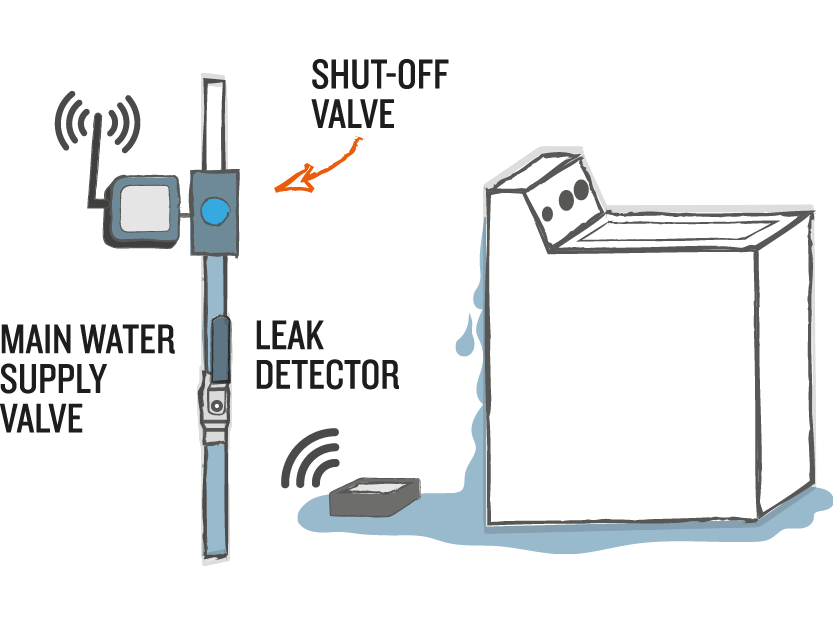

SHUT-OFF VALVE WITH WATER LEAK DETECTORS

Prevent water damage from plumbing systems and household appliances

- These detectors are installed next to plumbing fixtures and appliances such as: washing machines, dishwashers, water heaters, toilets and sinks.

- If a leak is detected, a signal is sent to an electronic unit that closes the main water supply in the home.

Save up to 10% on your basic home insurance premium

LEAK DETECTORS CONNECTED TO A CENTRAL MONITORING SYSTEM

Limit water damage from plumbing systems and household appliances

- These detectors are installed next to plumbing fixtures and appliances such as: washing machines, dishwashers, water heaters, toilets and sinks.

- If a leak is detected, a signal is sent to the central alarm monitoring station.

Save up to 5% on your basic home insurance premium1

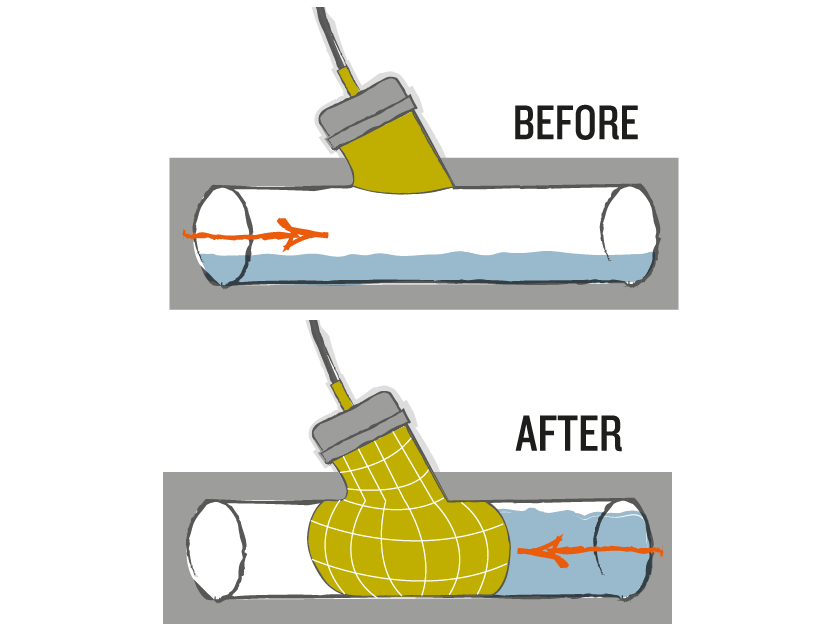

PNEUMATIC BACKFLOW SYSTEM

Used to prevent water damage caused by sewer back-up

- This smart valve consists of a balloon and water sensors.

- In case of sewer back-up, the balloon inflates to block water coming into the pipe in less than 15 seconds.

Save 10% on the Water damage ̶ Ground water and sewer back-up (Endorsement 16c) portion of your home insurance policy